Skyrocketing demand for affordable rentals continues as the average wage earner struggles to be able to afford to live in some of the priciest states. In 2016, a worker would need to make at least $20.30/an hour to rent a simple basic two bedroom home without devoting more than 30% to housing costs. Of course, this varies by city and states but it's definitely an eye opener.

The Hourly Wage Needed to Rent a 2-Bedroom Apartment Is Rising

A new report maps how much the average American has to earn to comfortably afford a modest rental in every U.S. state.

By Tanvi Misra - May 26, 2016

In 2015, the demand for rental apartments reached its highest level ever since the 1960s. The pinched access to mortgage credit after the Great Recession is one reason why. Another is that many Americans—especially the poor and people of color—haven’t felt the effects of the economic recovery, and may not be able to rustle up the funds for a down payment. A third reason is that Millennials, now the largest generation ever since the baby boomers, are especially loath to buy homes. The supply of rentals, especially at the lower end of the market, has been no match for the skyrocketing demand.That means it’s getting harder and harder for average Americans to afford a modest rental in the U.S., a new report by the National Low Income Housing Coalition finds. “The lowest-income renters without housing assistance have always struggled to afford housing, but in recent years they have become even more squeezed as more households enter the rental market,” Andrew Aurand, the vice president of research at NLIHC, tells CityLab.

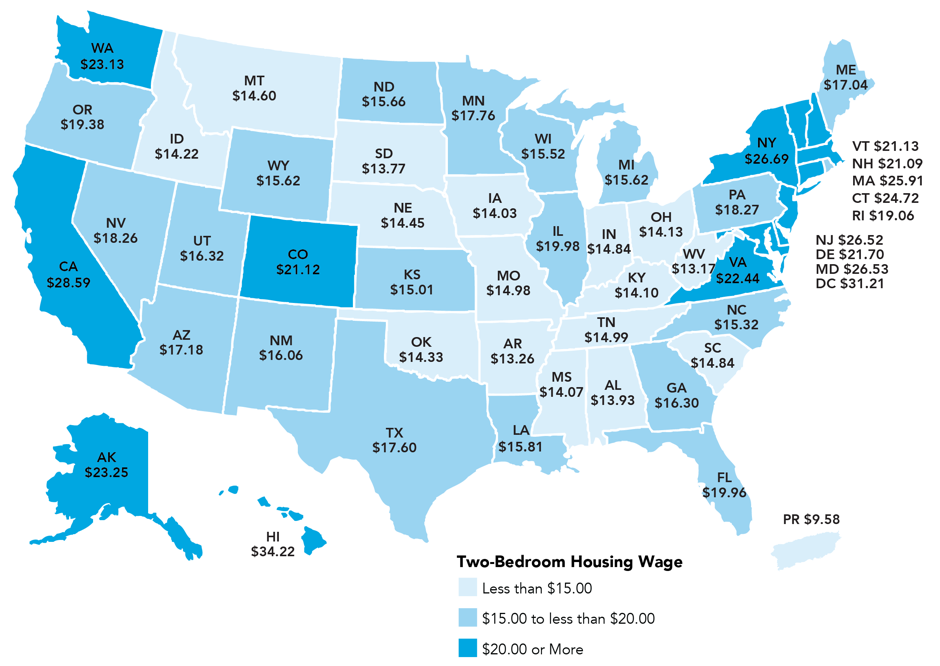

In 2016, a worker would need to make $20.30 per hour to rent a two-bedroom accommodation comfortably—without devoting more than 30 percent of income on housing costs. Last year, NLIHC pegged this “housing wage” at $19.35 an hour. (And we’re not talking about luxury apartments here. The report tallies this average hourly wage against the Department of Housing and Urban Development’s Fair Market Rent, an annual estimate of what a family might pay to live in a simple apartment.)

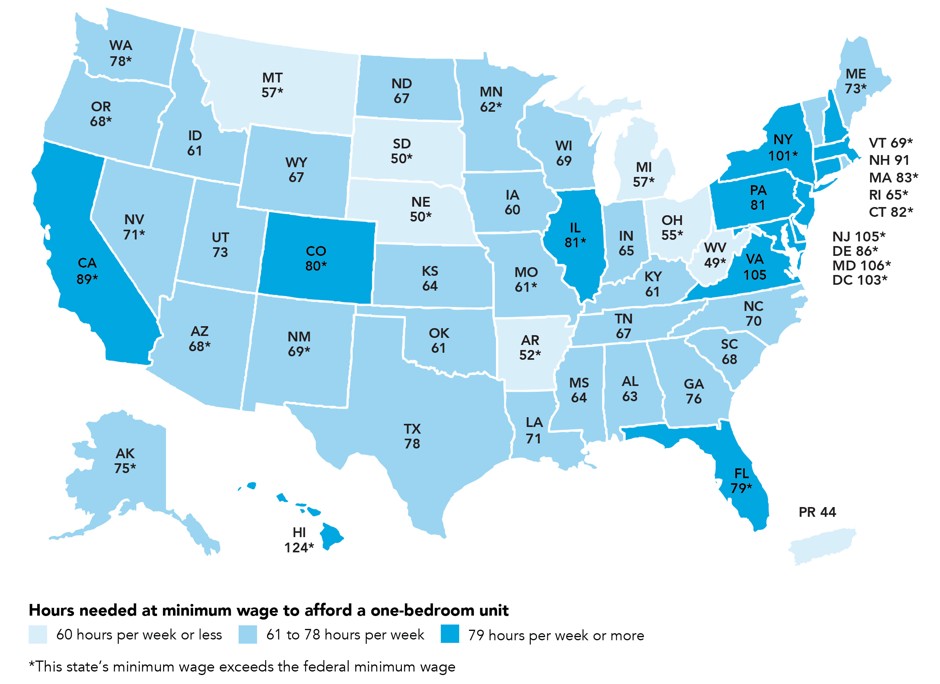

To really understand the weight of 2016’s housing wage, consider this: The average hourly wage for Americans is actually $15.42 per the report, which is not nearly enough to afford a two-bedroom. And the federal minimum wage, at $7.25, is around a third of what’s required. That means minimum-wage workers would have to work three jobs, or 112 hours a week, to be able to afford a decent two-bedroom accommodation. From the report:

If this worker slept for eight hours per night, he or she would have no remaining time during the week for anything other than working and sleeping.Of course, both the rental-housing market and hourly wages vary by state. The map below illustrates the differences in “housing wages” by state. Among the states, Hawaii has the highest hourly wage requirement ($34.22) for a two-bedroom. Among U.S. metros, San Francisco is at the top with $44.02.

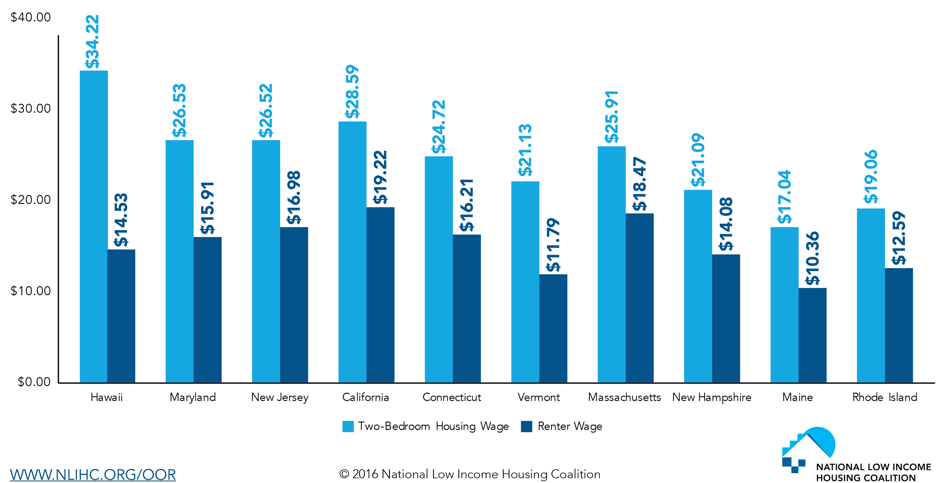

And here’s a graph showing the states with the biggest gaps between the current hourly wages and housing wages. Again, Hawaii leads this list:

Raising the minimum wage would undoubtedly narrow these gaps, but it’s still just not enough: “At least 22 local jurisdictions now have a minimum wage higher than their prevailing state or federal level. All fall short of the one-bedroom and two bedroom Housing Wage,” the report reads. The key lies—you guessed it—in expanding the affordable housing supply. Writes HUD Secretary Julian Castro, in the report’s preface:

This report confirms that investing in affordable housing — as HUD is doing by providing annual housing support for nearly 5.5 million households and through the new national Housing Trust Fund, as part of innovative efforts like the Rental Assistance Demonstration, and with incentives like the Low Income Housing Tax Credit — is one of the most important steps we can take to help people succeed today, and live healthier lives long into the future.

Source: http://www.citylab.com/housing/2016/05/the-hourly-wage-needed-to-rent-a-2-bedroom-apartment-in-2016-mapped/484091/

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post. turnberry village aventura

ReplyDelete